The State of the Industry.

“We’re going to cover why this moment, heading into 2026 is a real inflection point for AI adoption in our industry. And we’ll break down the crucial difference between just having AI tools and actually having an AI strategy.”

How do regulators feel about AI?

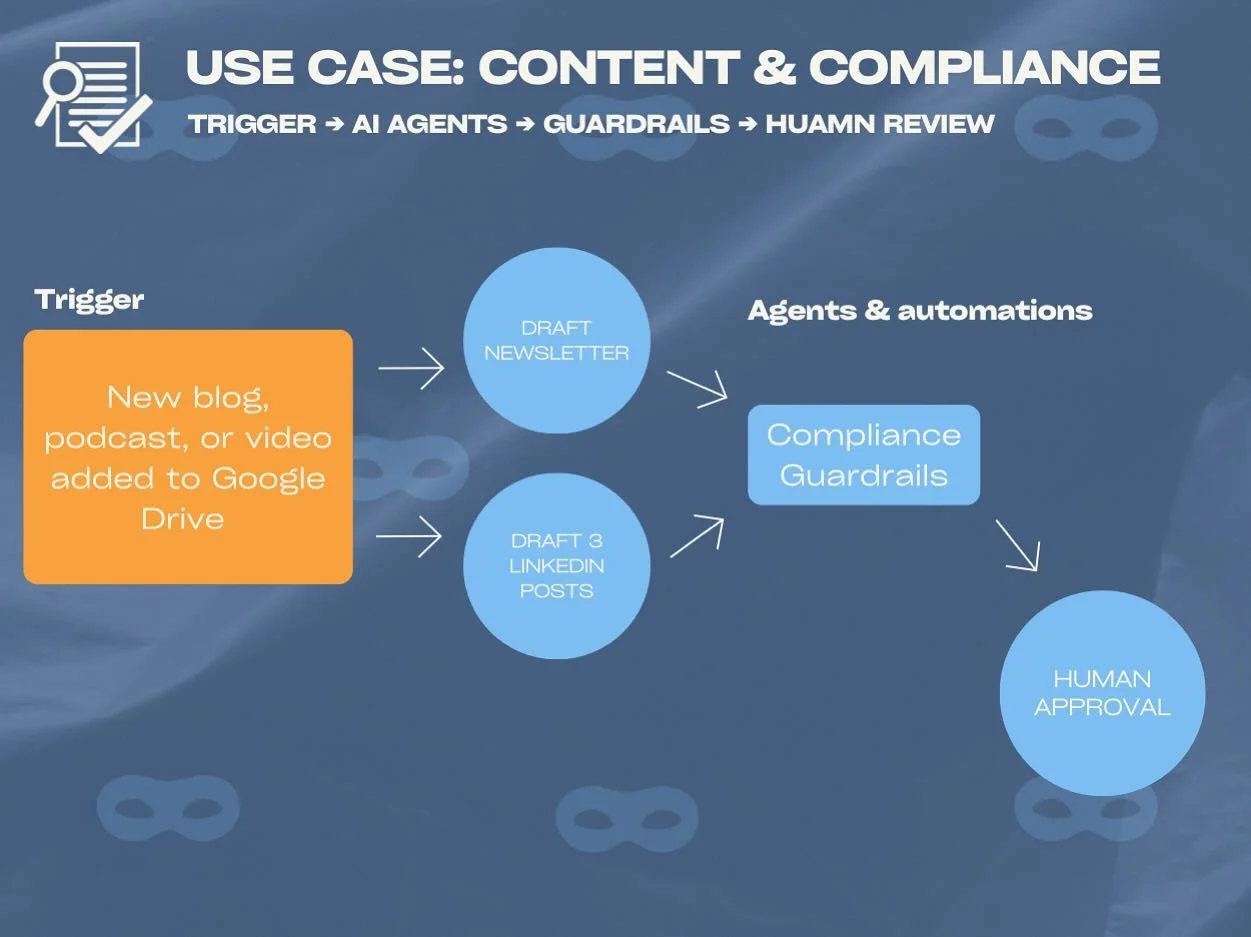

Regulators have lagged behind but they still expect firms to use new technology responsibly and according to existing policies. As of November 2025, FINRA, the SEC, and state regulators all share a similar stance: Use AI to support due diligence, accuracy, and client service, not to mislead clients or replace licensed human judgement. Technology must be supervised, outputs validated, processes documented, and humans in the loop for all client-facing decisions.

Last updated: November 28, 2025

AI solutions for representatives of:

Good advisors are getting cash off the sidelines.

Great advisors are preparing for the future.

Common causes for slow AI adoption in financial services

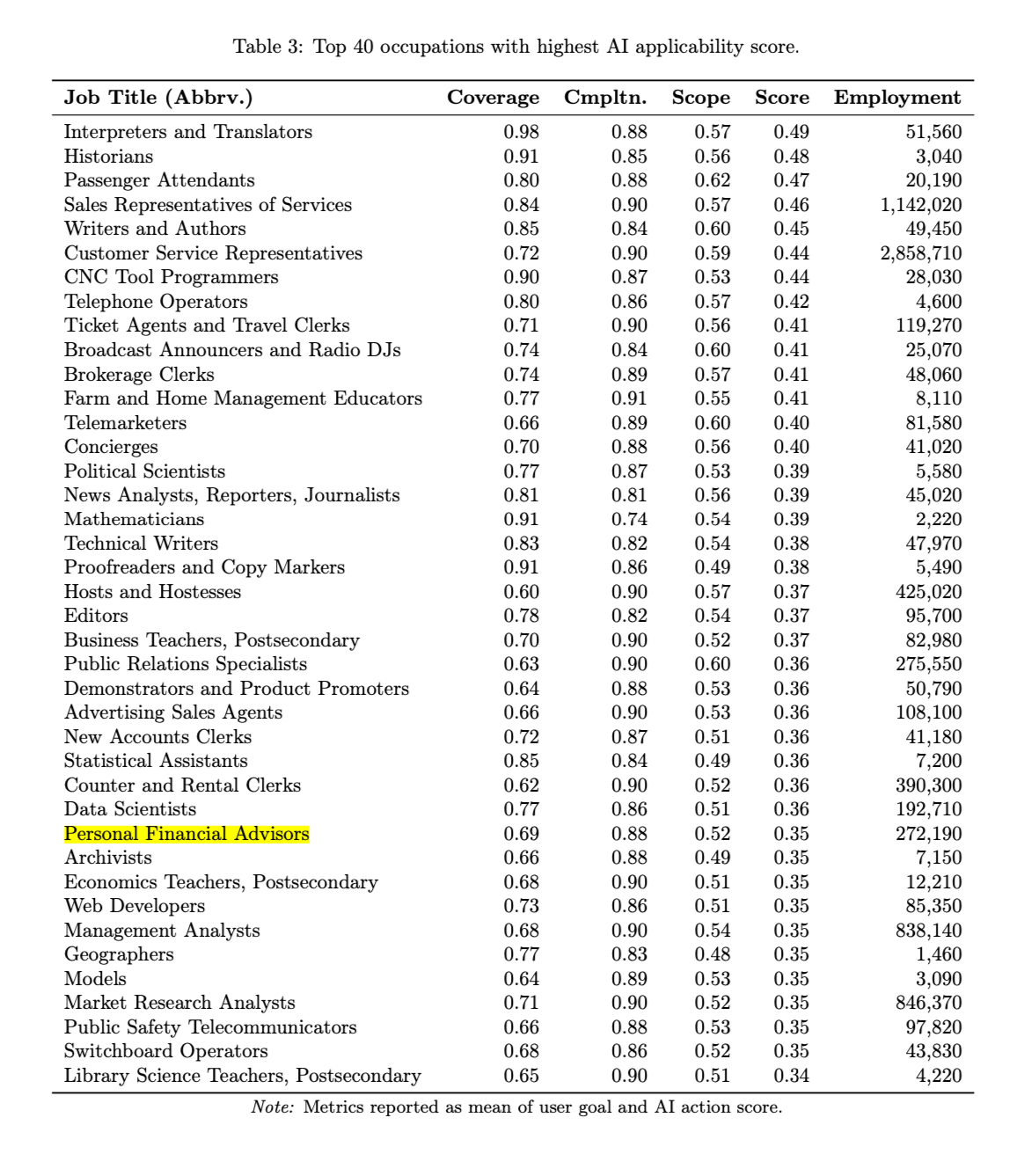

Financial advisors can delegate more tasks than most occupations.

In July 2025, Microsoft identified “personal financial advisors” as one of the “most applicable” jobs for AI task delegation.

When prompted for financial advisor job duties, 88% of tasks were successfully completed.

Competition is ramping up.

-

Robo advisors are digital investment services that use algorithms to automate building and managing investment portfolios. Robo advisors typically charge low or even no fees. The global robo-advisory market is expected to grow from $8.3 billion in 2024 to $33.6 billion by 2030.

-

Unlike robo advisors whose focus is investments, AI financial advisors offer AI-powered advice. They use large language models and machine learning to converse with clients in plain English, synthesize documents and data, run what-if scenarios, draft plans, and escalate to a human when needed. They can serve as a direct-to-consumer bot or serve as a co-pilot for a human advisor.

-

Banks are no longer just custodians or where clients park cash. Many banks are positioning themselves as full-service financial hubs where your accountant, financial advisor, and other professionals work within one bank.

-

Self-directed investment platforms and DIY apps let investors research, trade, and manage portfolios without a human financial advisor. The platforms offer investors a fast-setup, ease of use, and are often commission-free. Adoption of platforms like Robinhood has grown rapidly among young generations in recent years.

-

In NBC Securities’ 2025 outlook, advisors say client technology expectations have increased significantly. With more competitors to choose from, many younger investors say they would switch advisors to obtain holistic financial planning.

In September 2025, Origin released the first SEC-regulated AI financial advisor

The platform operates through a Registered Investment Adviser, and follows strict compliance and fiduciary standards while offering low fees. Users receive personalized daily reports and have 24/7 access to their AI advisor.

Last reviewed: November 2025

Stay informed on social media.

Frequently asked questions

-

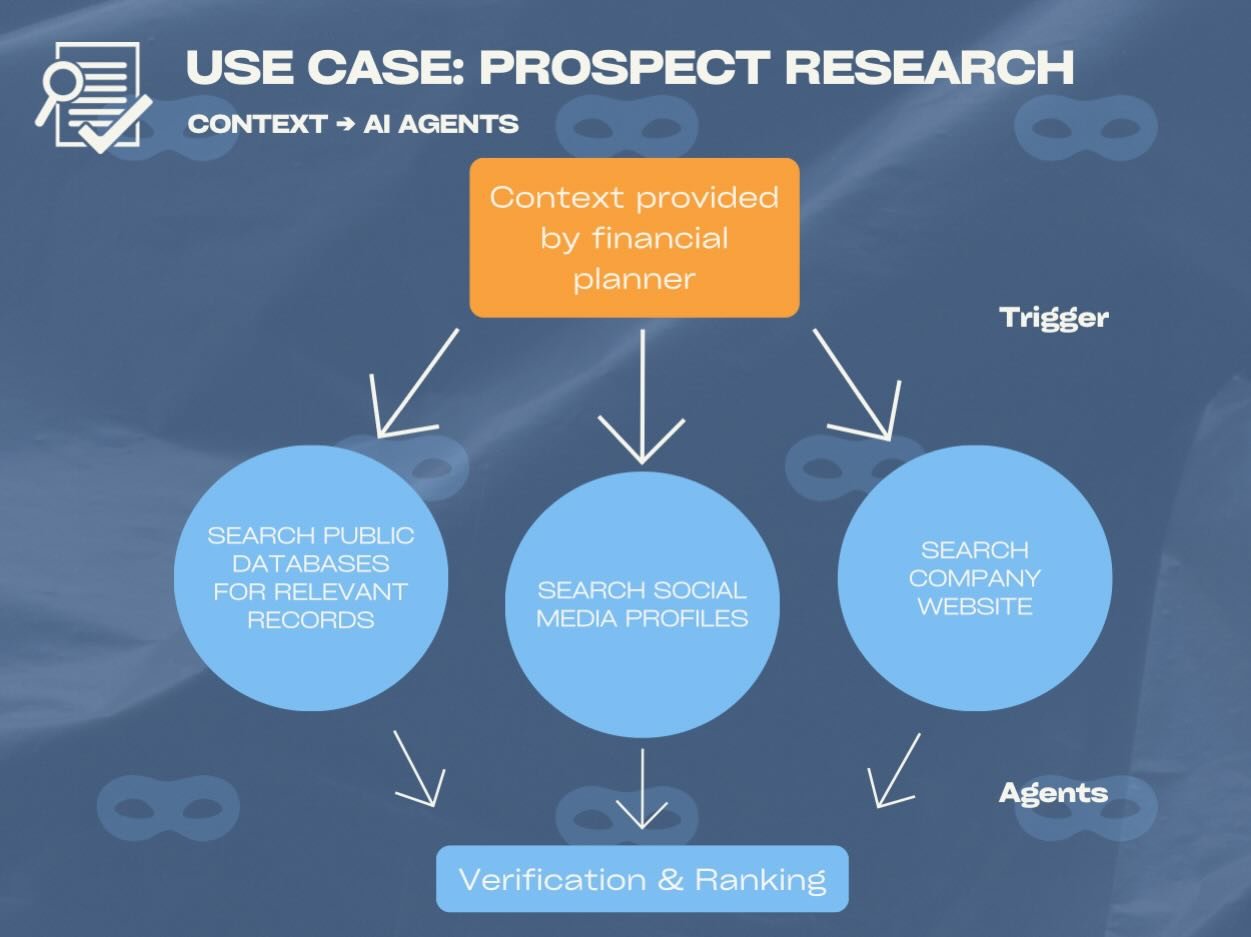

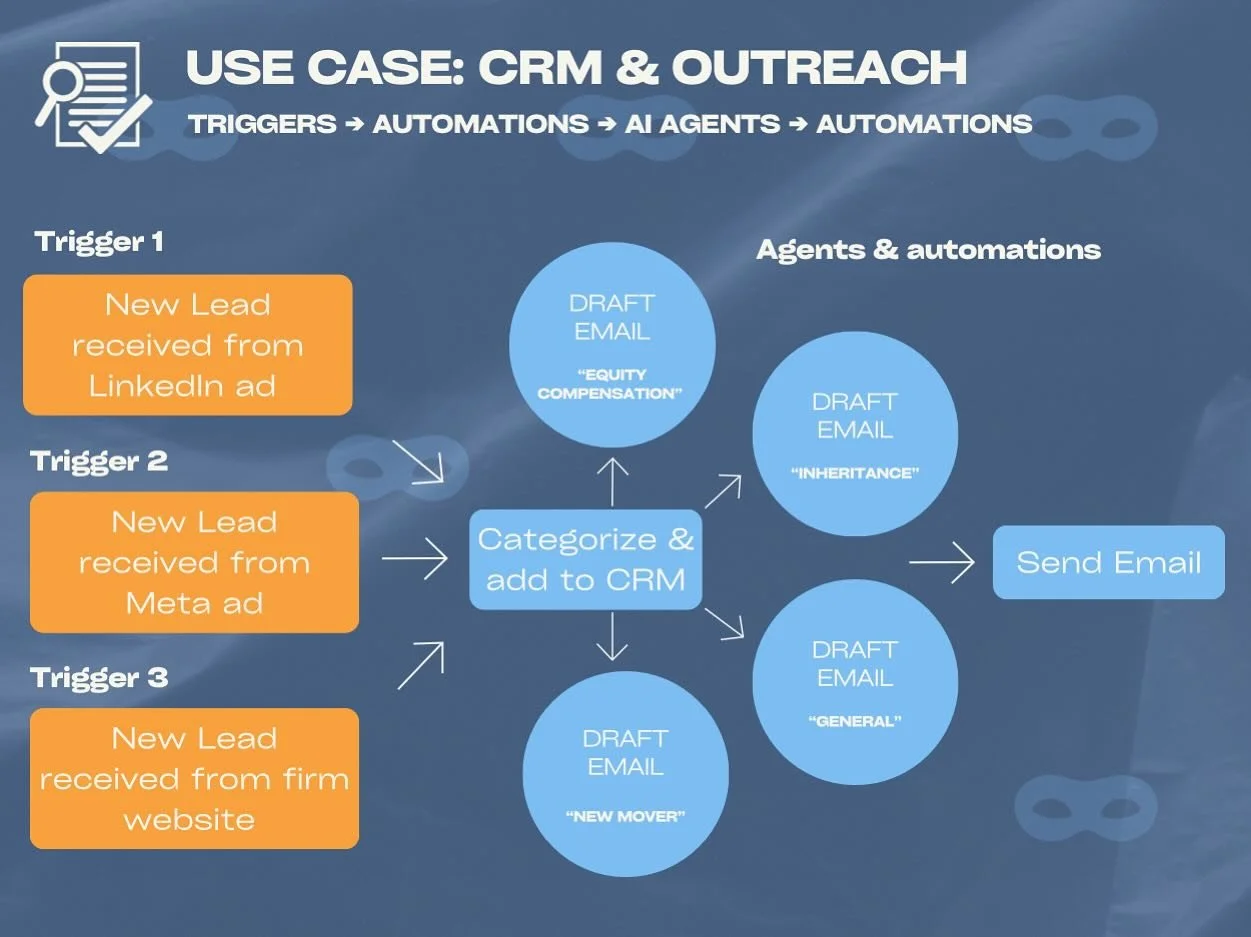

AI enhances client acquisition by automating lead scoring, identifying prospect patterns and generating personalized outreach—allowing advisors to focus on high‑value conversations. A 2025 survey found that the share of advisors using AI multiple times per day jumped from 9 % in 2024 to 24 % in 2025 , and 43 % use it to draft client communications

-

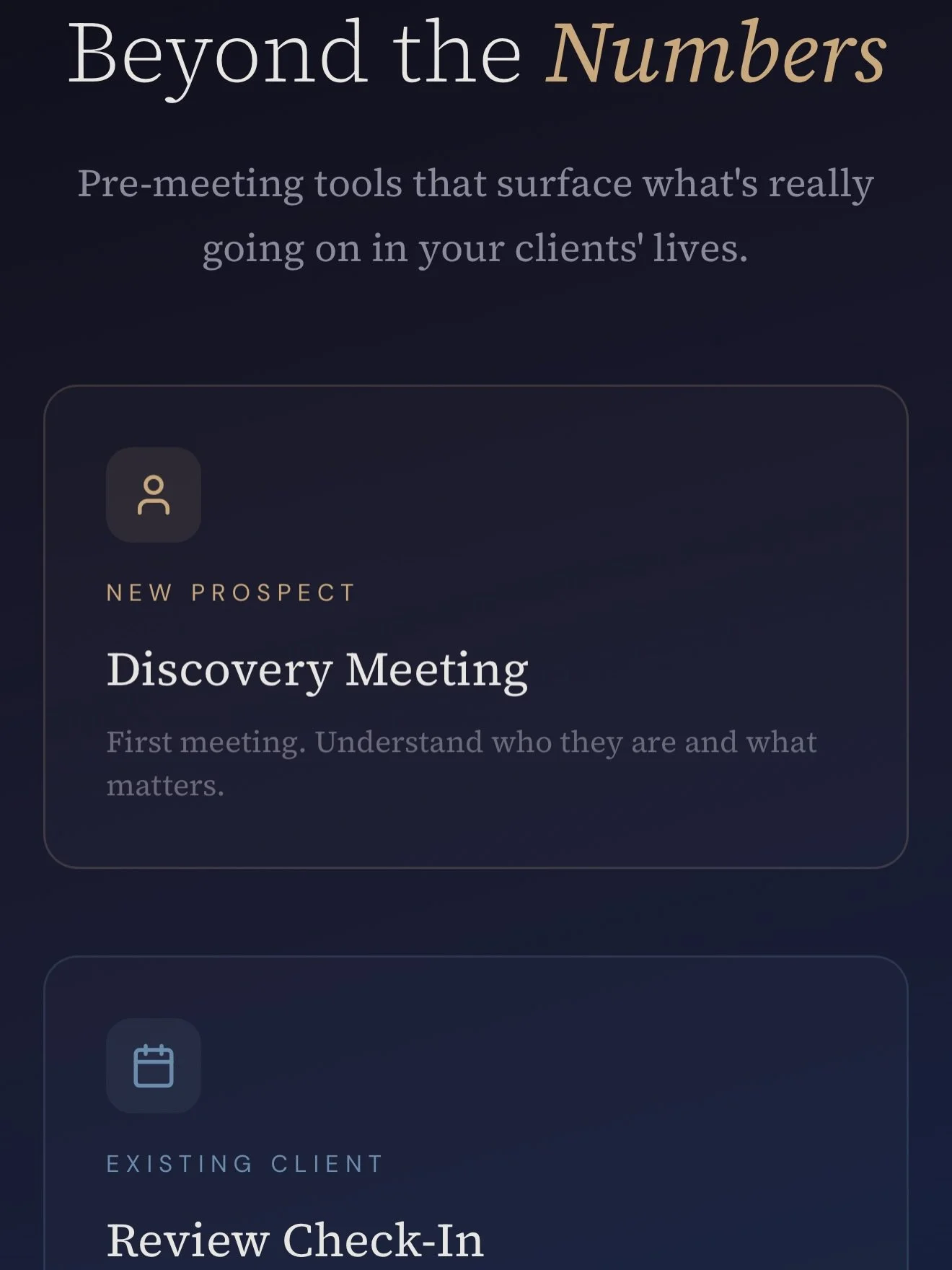

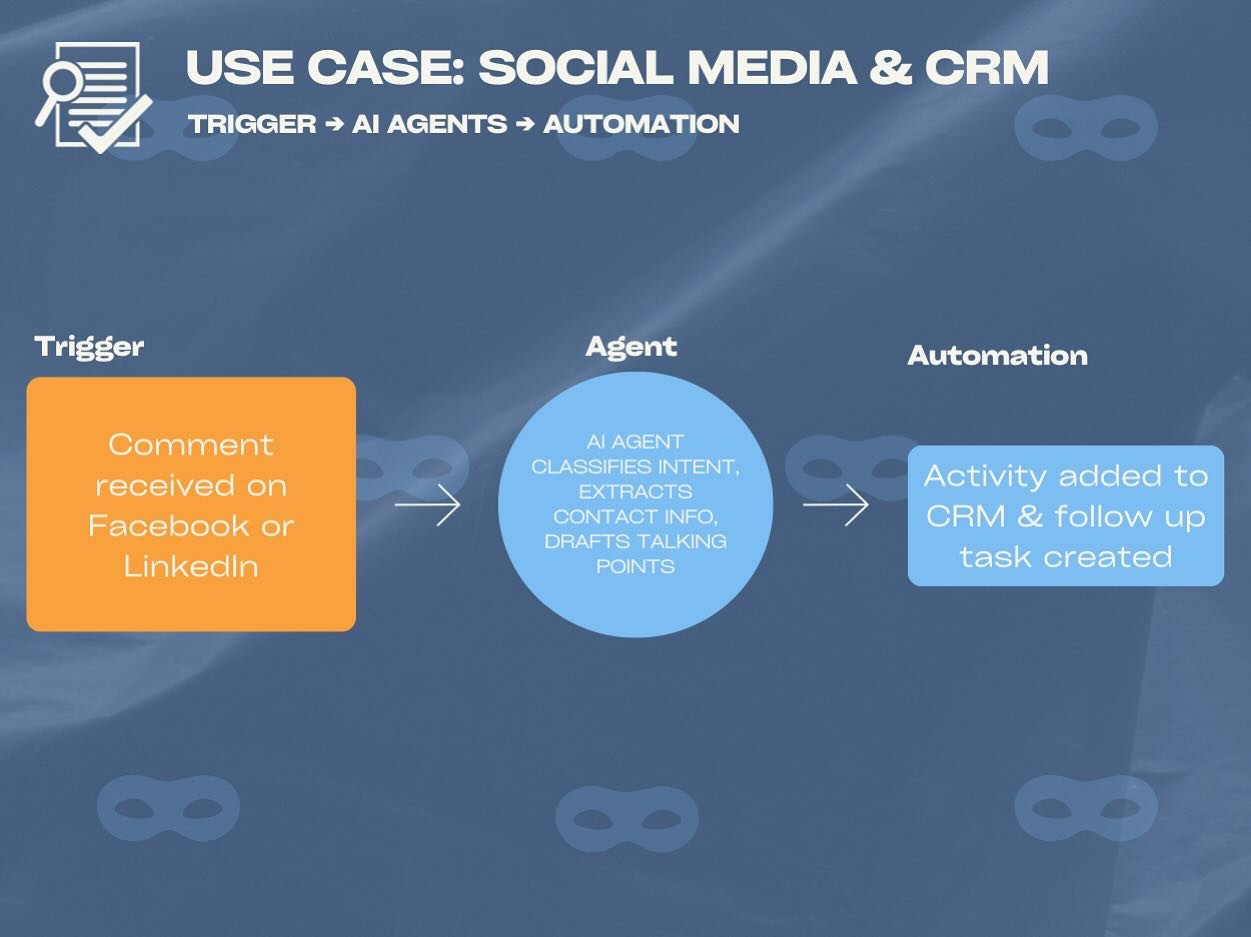

AI tools for financial advisors automate scheduling, data entry and meeting documentation, freeing up hours for client service. Popular uses include auto‑populating CRM fields, drafting and summarizing meeting notes, and detecting anomalies for fraud prevention.

-

AI enables deeper personalization by analyzing client data, predicting behavior and generating tailored insights. It should augment—not replace—your professional judgment. Two‑thirds of advisors now use AI in an iterative, conversational manner , and 65 % of wealth‑management firms expect AI to improve client relationship management

-

AI tools are subject to existing securities regulations—there is no special AI exemption. FINRA’s Regulatory Notice 24‑09 reminds firms that rules are technology‑neutral and AI outputs must be supervised . Advisors remain responsible for client communications and must ensure marketing is clear, fair and not misleading.

-

AI is a powerful tool but not a substitute for human advisors. Generative AI lacks ethics, contextual understanding and the comprehensive planning expertise that clients seek . Advisors remain responsible for all advice and must treat AI as an assistant rather than a decision‑maker.

-

AEO focuses on delivering clear, structured answers that AI tools can easily parse and cite. Write in a conversational tone, organize information with headings and bullet points, and maintain authority through reputable sources. Regular updates and FAQ sections improve your chances of being surfaced by ChatGPT, Gemini and other answer engines.